![]()

18th Annual

European AML & Financial Crime

Conference

A Global Outlook

11/12 November 2024

Held hybrid - Merchant Taylor's Hall, City of London

Welcome

Join us this November for your principal AML/CTF & financial crime updates 2024!

A cross-industry leader in enriching public-private partnership to help most effectively combat ML/TF & financial crime, we represent the industry voice to policymakers, governments, and law enforcement.

AMLP looks forward to welcoming you to its flagship AMLP’s 18th Annual European AML & Financial Crime Conference – A Global Outlook, 11/12th November 2024, the magnificent Merchant Taylors’ Hall, London, EC2R 8JB.

On Day 3, we will hold AMLP’s 13th Annual Anti-Bribery & Corruption Forum, 13th of Nov 24 (bookable separately).

Building on the success of last year’s sold-out event, the 2024 Forum is set to convene most pioneering and forward-thinking Senior financial crime prevention professionals, all dedicated to the relentless fight against financial crime. This exclusive gathering offers an unparalleled opportunity for experts to come together, share cutting-edge insights on emerging threats, and discuss the latest and most effective best practices to address these challenges head-on.

Don’t miss this chance to be at the forefront of the financial crime prevention community, shaping the future of our collective efforts. Engage in powerful dialogues with peers, benchmark your approaches, and share knowledge and solutions with professionals from the UK, Europe, and beyond.

This event is held in hybrid format – delegates are able to attend in person or virtually.

Testimonials

“It was a great event, with so many topics discussed, some serious debate and a chance to see old friends F2F again”.

“I wish to congratulate AMLP for organising another productive conference. Everything was so well organised and the topics covered were all extremely pertinent”.

“AMLP Forum remains the best one – it is great to see it grow and bring more European, international & newer industry audiences. It was a great networking opportunity and many potential business opportunities”.

Event Summary

This event brings together leading stakeholders to examine the latest strategies, most pressing topical issues and practical measures to combat ML/TF, financial crime, fraud, ESG, sanctions evasion and anti-bribery & corruption.

It provides an excellent opportunity to learn about recent AML/CTF international regulatory and legislative changes, best implementation practices, and share knowledge and solutions with professionals from UK, Europe and further afield.

Speakers

We are delighted to announce that this year, T. Raja Kumar, FATF President 2022-2024 will provide a Special Keynote Address.

Opening Addresses will be delivered by our stellar line-up of distinguished experts including:

- Alina Nedea, Head of Unit, Sanctions, Directorate-General for Financial Stability, European Commission

- Burkhard Mühl, Head of Department European Financial and Economic Crime Centre, Europol

- Marcus Pleyer, Deputy Director General, German Federal Ministry of Finance & Former FATF President 2020-2022

- Raluca Pruna, Head of Financial Crime Unit, DG FISMA, European Commission

Expert sessions will be delivered by high-profile speakers including:

- Cedric Perruchot, Head of AML Regulatory Affairs & Advocacy, BNP Paribas

- Dr. Damien Romestant, Global Lead Trade Compliance Counsel, CEVA Logistics France

- Daniel Marius Staicu, Head of FIU Moldova, and previously Head of FIU Romania

- Dave Laramy, Head of 1st Line Fraud, ABC & Tax Evasion, Danske Bank

- Gregory Dellas, Chief Compliance and Innovation Officer, Ecommbx

- Howard Rawstron, Head of Economic Crime Risk Management Framework Team, Lloyds Banking Group

- Jean-Marc Guiteau, Chief Compliance Officer, Société Générale PWM Luxembourg

- Karim Tadjer, Global Head of Financial Crime and Fraud Prevention, ING Group

- Kaswar Hameed, EMEA Head of Financial Crime Compliance, SMBC Group

- Kevin Lacks-Kelly, Head of the NWCU, UK Metropolitan Police & Interpol Lead on Wildlife Crime

- Lee Hale, Senior Managing Director, Risk, Forensics & Compliance, Ankura

- Marcus Wogart, Group Head of financial Crime Risks, NatWest

- Mark McDavitt, Director of FCO & FCRC, Metro Bank

- Marta Piosik, Global Financial Crime Monitoring Head, UBS

- Nick Maxwell, Head of the Future of Financial Intelligence Sharing FFIS EC Research Programme

- His Honour Judge Michael Hopmeier, Southwark Crown Court

- Rachel Sexton, Partner, Ashurst Risk Advisory

- Ralph Nash, Global Chief Risk & Compliance, HSBC

- Stewart McGlynn, Head, Anti-Money Laundering and Financial Crime Risk, Hong Kong Monetary Authority

- Shahanaz Müller, Partner, AML & Sanctions – Compliance Advisory, Deloitte

- Thomas McDavid, Director, Head of Financial Crime, Sotheby’s

- Willem Schudel, Head of Department, Financial Crime Supervision, DNB

And many more…

Key Topics 2024

This year’s stellar line-up of leading experts will delve into the latest financial crimes and geopolitical threats, as well as the most pressing issues affecting AML/CTF, financial sanctions, trade controls, fraud, ESG, slavery, anti-bribery and corruption, asset confiscation, and advancements in intelligence sharing.

- FATF on emerging ML/TF threats, strategic priorities, Rec. updates, and ensuing Guidance

- Preparing for the implementation of the EU AML Package & AMLA – establishing the new EU Authority for success

- Regulatory and policy roundtable: key risk-based priorities – evolving strategies for effective oversight

- Law enforcement on the changing nature of transnational criminality, impact of tech, information sharing, unleashing the power of unexplained wealth orders, and asset confiscation

- Economic sanctions priorities on both sides of the Atlantic – tackling current challenges and violations

- Evolving CDD/KYC trends through an effective RBA, leveraging of real time data, GDPR compliance & AI

- Advancing an effective enterprise-wide programme – eliminating inefficiencies & strengthening defences

- AI-driven monitoring, investigations & SARs reporting – innovative ways to detect & report ML/TF & fraud

- ESG & slavery: increasing role of AML monitoring of transactions and payments

- Tackling the financial fraud ML amid EU Instant Payment Directive– developing an effective response

- TCSPs, shell companies & public registries: a push for tougher transparency in beneficial ownership and source of wealth/funds – rising standards

- Crypto-assets & CBDCs – effectively managing nested ML & financial crime exposure with MiCA & Travel Rule

- Trade based ML – leading risk mitigation strategies to tackling evolving ML, fraud, and sanctions risks

- Advancing data integration, automation, AI & cutting-edge technology to combat emerging financial crimes & fraud tactics

- Payment transparency – adapting to the new FATF Rec. 16

and many more…

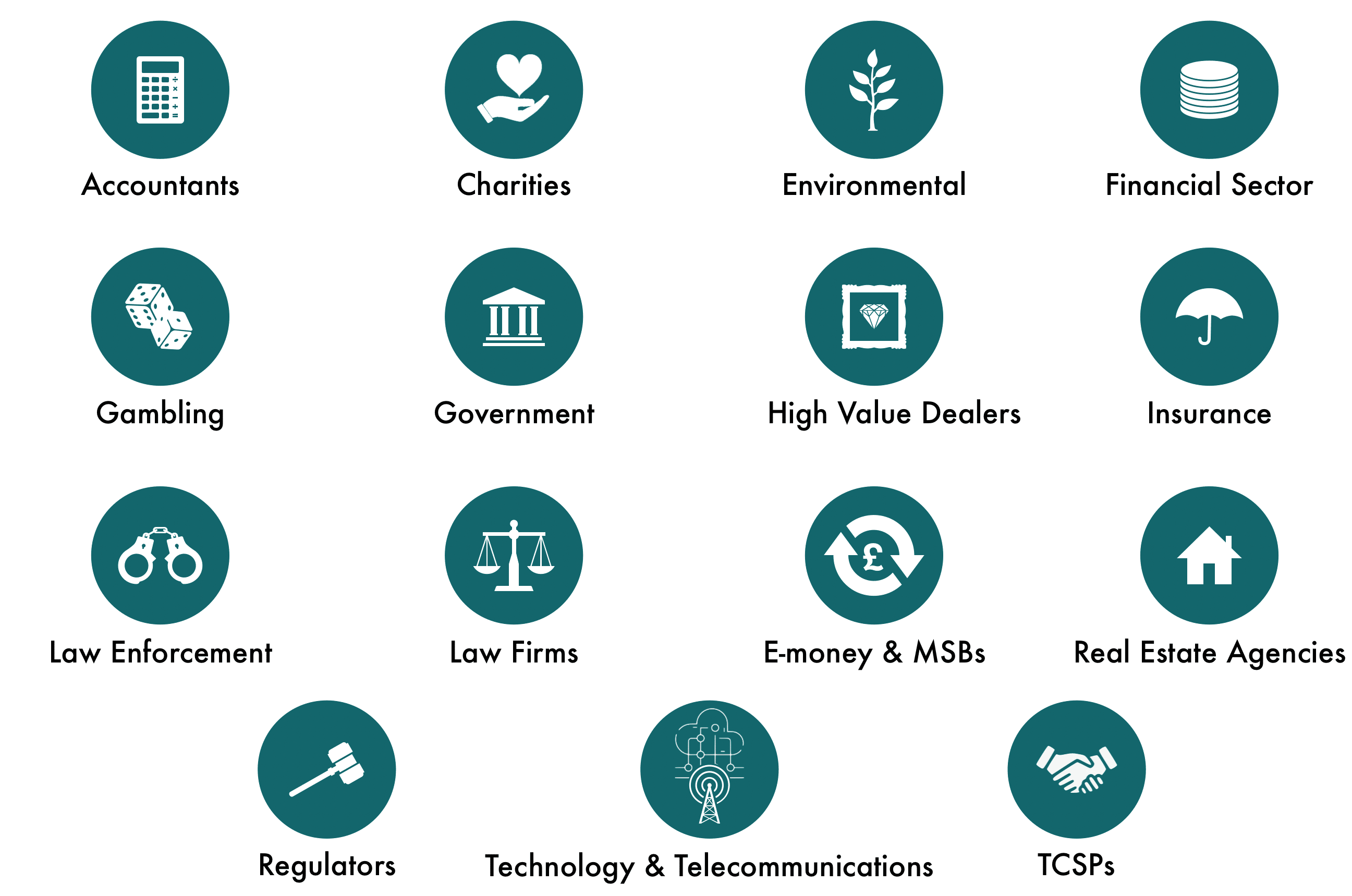

Sectors in attendance

Benefits

The Conference will provide a unique opportunity for financial crime, AML/CTF professionals to learn about the latest trends, best implementation practices, compare and benchmark their activities and discuss related concerns with peers from across the UK, Europe and further afield.

For any queries, please do not hesitate to contact Diane at fc@amlpforum.com

We look forward to welcoming to you on day!

Registration

Registration

Please contact us to confirm your place. For enquiries, including PO. numbers and multiple bookings, contact us at fc@amlpforum.com

This event is held in hybrid format – delegates are able to attend in person or virtually.

Discount Offers

Discount Offers

- Member discount applies to academics, charities, law enforcement & Government.

- 10% discount applies to members of Banking Associations of: Croatia, Cyprus, Estonia, Hungary, Latvia, Lithuania, Malta, Norway, Slovakia, Sweden – please contact us if your country is not listed.

- Bring 3 or more delegates – please contact us for enterprise discounts.

- Book both the Conference and Masterclass receive a 13% discount – 1st of Aug & 10% from then on

- Early bird discount 13% – 1st Aug 24

*Discount offers cannot be combined.